Car insurance quotes in Minnesota provide accurate and affordable options for drivers in the state. In Minnesota, it is important to compare car insurance quotes to find the best coverage at the lowest price.

With a wide range of reputable insurance providers available, drivers can easily obtain multiple quotes to ensure they are getting the best deal possible. Car insurance quotes in Minnesota take into account factors such as driving record, age, and vehicle type to determine the cost of coverage.

By comparing quotes, drivers can find the policy that best fits their needs and budget.

2. Understanding Car Insurance

Car insurance is a crucial aspect of owning a vehicle. It provides financial protection against unforeseen circumstances such as accidents, theft, or damage to your car. In this section, we will delve into the details of car insurance, including what it is, its importance, and the different types of coverage available.

2.1 What Is Car Insurance?

Car insurance is a contract between you and an insurance company that safeguards you financially in case of car-related mishaps. In exchange for paying a premium, the insurance company agrees to cover your losses as outlined in the policy’s terms and conditions.

It’s important to note that car insurance is not only a legal requirement in most states, but it also offers you the financial protection and peace of mind you need while on the road. By having a car insurance policy, you can minimize the financial burden of repairing or replacing your vehicle in case of an accident or other covered events.

2.2 The Importance Of Car Insurance

Car insurance is more than just a legal obligation — it is a smart investment that can potentially save you from significant financial losses. Here are a few reasons why car insurance is vital:

- Protection against financial liability: Car accidents can result in property damage, medical expenses, or legal liabilities. A comprehensive car insurance policy can cover these costs, ensuring that you are not left with an overwhelming financial burden.

- Personal protection: Car insurance also protects you and your loved ones. In case of an accident, you may be entitled to compensation for medical expenses, lost wages, or even disability benefits.

- Peace of mind: Knowing that you have car insurance allows you to drive with peace of mind, knowing that you are financially protected against unexpected events.

2.3 Types Of Car Insurance Coverage

There are various types of car insurance coverage available, and it’s important to choose the right one based on your needs and circumstances. Here are some common types of car insurance coverage:

| Type of Coverage | Description |

|---|---|

| Liability coverage | This coverage protects you if you are at fault in an accident and cause damage to another person’s property or injuries to them. |

| Collision coverage | This coverage pays for damages to your car if you collide with another vehicle or object. |

| Comprehensive coverage | This coverage provides protection against damages to your car caused by factors other than collisions, such as theft, vandalism, or extreme weather conditions. |

| Uninsured/underinsured motorist coverage | This coverage helps you in case you are involved in an accident caused by a driver who does not have sufficient insurance coverage to pay for the damages. |

These are just a few examples of the car insurance coverage options available. It’s important to carefully consider your needs and consult with an insurance professional to determine the best coverage for your specific situation.

Credit: www.thezebra.com

3. Factors Affecting Car Insurance Premiums

Car insurance premiums can vary significantly from one individual to another, and this is due to several factors that insurers consider when determining the cost of coverage. Understanding these factors can help you make informed decisions when it comes to purchasing car insurance in Minnesota. Here are the key factors that can affect your car insurance premiums:

3.1 Driving Record And History

Your driving record and history play a crucial role in determining your car insurance premiums. Insurers assess the risk associated with your driving behavior and may charge higher premiums if you have a history of accidents, speeding tickets, or other traffic violations. On the other hand, a clean driving record can earn you lower insurance rates.

3.2 Age, Gender, And Marital Status

Your age, gender, and marital status are significant factors considered by insurers when calculating premiums. Younger, inexperienced drivers are often charged higher rates due to their higher likelihood of being involved in accidents. Additionally, statistics show that males tend to have more accidents than females, which can result in higher premiums for male drivers. Marital status can also influence premium rates, as married individuals are generally perceived as lower-risk drivers.

3.3 Type Of Vehicle

The type of vehicle you drive can impact your car insurance premiums. Insurance companies categorize vehicles based on factors such as their make, model, age, and safety features. Typically, vehicles with high performance, expensive repairs, or a higher likelihood of theft usually come with higher insurance premiums. On the other hand, safe and reliable vehicles often have lower insurance costs.

3.4 Credit Score

Your credit score can also affect your car insurance premiums. Insurers may consider your credit history as an indicator of your financial responsibility. Those with poor credit scores may face higher premiums as they are perceived to be higher-risk individuals. Maintaining a good credit score can help you secure better rates on your car insurance in Minnesota.

3.5 Location And Intended Use

Your location and the intended use of your vehicle can impact your car insurance premiums. Insurers often take into account where you live and drive as certain areas may have higher rates of accidents or theft. Additionally, how you use your vehicle can influence premiums too. Those who primarily use their cars for commuting may face higher rates compared to those who drive less frequently.

Keep in mind that these factors are not exhaustive, and insurance providers may consider additional elements when determining your car insurance premiums. Being aware of these factors can help you understand why your premium may differ from others and how you can potentially lower your insurance costs.

4. Comparing Car Insurance Quotes In Minnesota

When it comes to car insurance in Minnesota, getting quotes from different insurance companies and comparing them can help you find the best coverage and rates for your specific needs. Comparison shopping is essential to ensure you are getting the most value for your money. In this section, we will discuss the importance of comparison shopping, how to gather necessary information, popular car insurance companies in Minnesota, and online tools and resources to help you compare quotes easily.

4.1 Importance Of Comparison Shopping

Comparison shopping is vital when it comes to car insurance because prices and coverage can vary significantly from one provider to another. By comparing quotes, you can identify insurance policies that offer the best value for your specific requirements. It allows you to evaluate different coverage options, discounts, and deductibles to find the most affordable and suitable plan for you.

4.2 Gathering Necessary Information

Before you start comparing car insurance quotes, it’s important to gather all the necessary information to provide accurate details to the insurance companies. The following information will be required:

- Your personal details: Name, address, date of birth, and contact information.

- Vehicle details: Make, model, year, vehicle identification number (VIN), current mileage, and any safety features.

- Your driving history: Number of accidents or traffic violations in the past few years.

- Preferred coverage options: Liability coverage limits, comprehensive coverage, collision coverage, and deductible preferences.

4.3 Popular Car Insurance Companies In Minnesota

Minnesota is home to several reputable car insurance companies that offer competitive coverage options. Some of the popular car insurance companies in Minnesota include:

- State Farm

- Progressive

- Allstate

- Geico

- Liberty Mutual

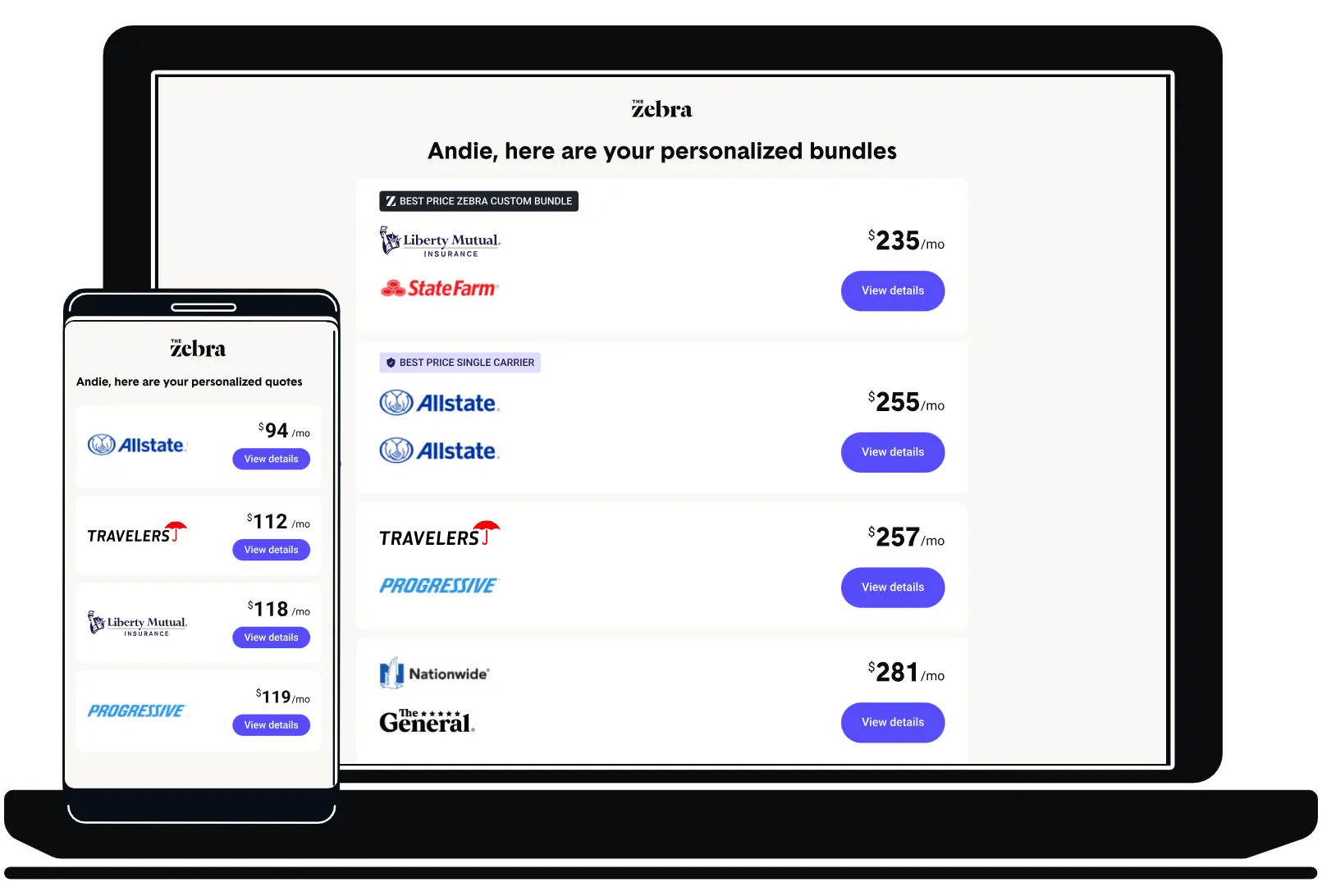

4.4 Online Tools And Resources For Comparing Quotes

To simplify the process of comparing car insurance quotes in Minnesota, there are various online tools and resources available. These tools allow you to enter your information once and receive multiple quotes from different insurance companies. Some notable online resources to help you compare quotes include:

- NerdWallet

- The Zebra

- Insurance.com

- Compare.com

Using these online tools can save you time and effort by providing you with a clear overview of different quotes and coverage options available. It’s important to note that while these tools can be helpful, it’s advisable to directly contact the insurance companies to get a more accurate and detailed quote based on your specific situation.

Credit: www.usatoday.com

5. Tips For Getting The Best Car Insurance Deals In Minnesota

Car insurance is a necessity for every driver in Minnesota, but that doesn’t mean you have to settle for the first quote you receive. By following these tips, you can ensure that you’re getting the best car insurance deals in the state. From maintaining a good driving record to taking advantage of discounts, these strategies can help you save money while still preserving the coverage you need.

5.1 Maintaining A Good Driving Record

One of the most effective ways to lower your car insurance premiums is by maintaining a good driving record. Insurance companies reward safe drivers with lower rates, as they view them as less of a risk to insure. Avoiding accidents and traffic violations not only keeps you and others safe on the road but can also save you money in the long run.

5.2 Bundling Policies

Another way to secure the best car insurance deals in Minnesota is by bundling your policies.

Bundling refers to purchasing multiple insurance policies from the same provider. If you already have a homeowner’s insurance or renter’s insurance policy, consider adding your car insurance to the mix. By doing so, you may be eligible for a multi-policy discount, which can lead to significant savings on your premiums.

5.3 Taking Advantage Of Discounts

To maximize your savings, be sure to explore the various discounts offered by insurance companies.

Discounts can vary from one insurer to another, but some common ones include safe driver discounts, good student discounts, and discounts for completing a defensive driving course. Additionally, certain organizations or professions may qualify for specialized discounts. Taking the time to research and inquire about available discounts can help you secure better car insurance deals in Minnesota.

5.4 Setting Appropriate Coverage Limits

To obtain the best car insurance deals, it’s crucial to set appropriate coverage limits.

While it may be tempting to opt for the minimum coverage required by law, this may not provide enough protection in the event of an accident.

Determining the right coverage limits depends on factors such as the value of your car, your financial situation, and your risk tolerance. Consulting with an insurance professional can help you assess your needs and find the optimal coverage limits that balance cost-effectiveness and protection.

5.5 Reviewing And Updating Insurance Periodically

Lastly, regularly reviewing and updating your car insurance policy is essential to ensure you’re still getting the best deal.

As life circumstances change, your insurance needs may change as well.

For example, if you’ve recently paid off your car loan or your teen driver has moved out of state, these changes can impact the coverage you require. By reviewing your policy annually or whenever significant changes occur, you can make any necessary adjustments to ensure you’re not overpaying for coverage you no longer need.

By following these tips, you can increase your chances of finding the best car insurance deals in Minnesota. Maintain a good driving record, bundle your policies, take advantage of discounts, set appropriate coverage limits, and review your insurance periodically to ensure you’re always getting the most affordable and comprehensive coverage possible.

Credit: www.nerdwallet.com

Frequently Asked Questions On Car Insurance Quotes Mn

How Much Is Car Insurance Per Month In Mn?

Car insurance costs in Minnesota vary, but on average, you can expect to pay around $100-$200 per month. Factors such as your driving record, age, and type of vehicle will affect the final price. Compare quotes from different insurers to find the best deal for you.

Who Is Known For Cheapest Car Insurance?

Progressive is known for offering the cheapest car insurance rates.

Is Geico Cheaper Than Progressive?

Yes, Geico may be cheaper than Progressive. Pricing varies based on factors like location, driving history, and coverage needs. It’s recommended to compare quotes from both providers to find the best value for your specific situation.

Why Is Minnesota Car Insurance So Expensive?

Minnesota car insurance is expensive due to factors such as high population density, severe weather conditions, and a high number of uninsured drivers. These elements increase the risk for accidents and claims, leading to higher premiums.

Conclusion

Choosing the right car insurance is crucial, and in Minnesota, where we strive to find coverage that fits our needs. With the help of car insurance quotes, we can make an informed decision. By comparing different policies and rates, we can ensure that we have the right coverage at the best price.

So, take the time to obtain multiple quotes, consider your individual requirements, and secure the protection you deserve for your vehicle in Minnesota.