Car insurance quotes in Colorado can be obtained easily and quickly online, making it convenient for residents to compare rates and find the best coverage for their needs.

2. Understanding Car Insurance Quotes

Car insurance quotes are a crucial aspect of ensuring your vehicle and yourself are adequately protected on the road. Understanding these quotes is essential before making a decision on your car insurance coverage. In this section, we will delve into the ins and outs of car insurance quotes, including what they are, factors that impact them, and how to obtain them.

2.1 What Is A Car Insurance Quote?

A car insurance quote is an estimate provided by insurance companies that outlines the cost of a specific insurance policy for your vehicle. It includes important details such as the coverage offered, deductibles, premiums, and any additional features. Essentially, it helps you understand how much you can expect to pay for your desired insurance coverage.

When requesting a car insurance quote, you will be asked to provide information about yourself and your vehicle, including details on your driving history, the make and model of your car, and the desired coverage limits. Insurance companies use this data, along with various other factors, to calculate the quote that best fits your needs.

2.2 Factors That Impact Car Insurance Quotes

Several factors play a significant role in determining your car insurance quote. Understanding these factors can help you make informed decisions and potentially lower your premium:

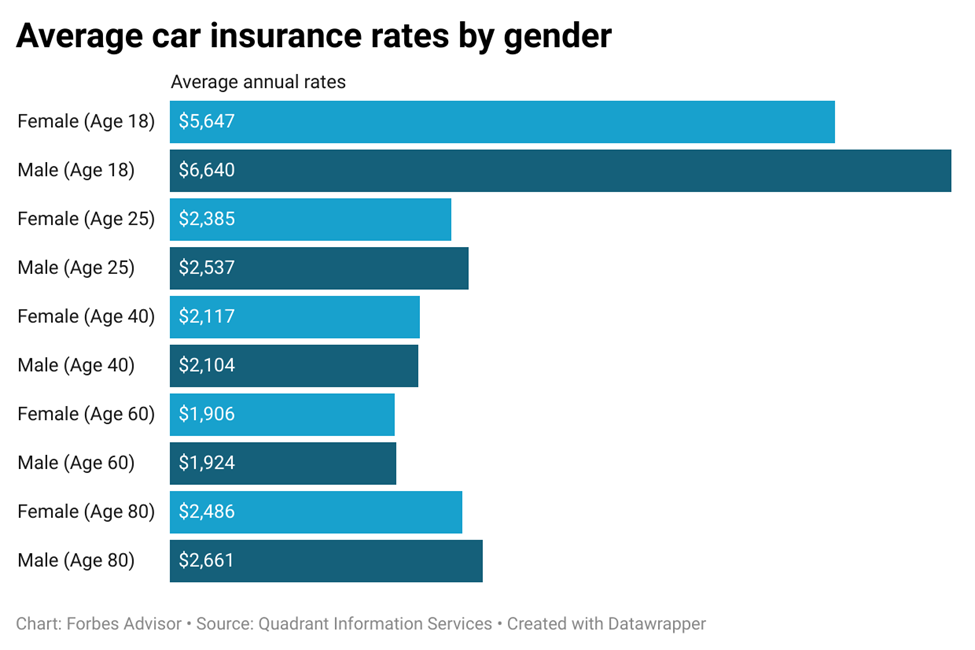

- Age: Younger and inexperienced drivers typically receive higher insurance quotes due to the increased risk associated with their age group.

- Driving history: Having a clean driving record with no accidents or traffic violations can help lower your insurance premium.

- Vehicle make and model: Certain cars have higher repair costs or are more prone to theft, which can result in higher insurance quotes.

- Location: Your zip code can affect your quote since areas with higher crime rates or a higher likelihood of accidents may result in higher premiums.

- Coverage limits: The amount of coverage you select will impact your quote. Higher limits generally lead to higher premiums.

2.3 How To Obtain Car Insurance Quotes

Obtaining car insurance quotes is a straightforward process. You have a few options to ensure you are getting the best possible rates:

- Online platforms: Many insurance companies offer online platforms where you can enter your information and receive quotes instantly. This option allows you to compare multiple quotes quickly.

- Insurance agents: Contacting insurance agents directly can help you personalize your coverage based on your specific needs. They can provide you with accurate quotes tailored to your requirements.

Regardless of the method you choose, make sure to provide accurate information when requesting quotes. Any discrepancies can lead to inaccurate estimates and potential issues when filing a claim.

By understanding the basics of car insurance quotes, including what they are, the factors that impact them, and how to obtain them, you will be better equipped to make informed decisions when selecting your car insurance coverage. Remember, it is essential to compare quotes from multiple providers to ensure you are getting the best value for your money.

Credit: www.usatoday.com

3. Finding The Best Car Insurance Deals In Colorado

When it comes to car insurance, finding the best deals is essential to ensure you not only meet legal requirements but also protect your vehicle and finances in case of an accident. While Colorado offers various car insurance providers, it’s crucial to research and compare different options to find the most suitable coverage for your needs. In this section, we will explore three key aspects to consider when searching for the best car insurance deals in Colorado.

3.1 Researching Different Insurance Providers

Before committing to any car insurance policy, it’s important to research and gather information about different insurance providers in Colorado. This initial step allows you to compare various factors like premium rates, coverage options, and customer satisfaction levels. Take the time to visit the websites of different insurance companies and assess their offerings. Look for established companies with a strong reputation and a wide range of coverage options. Additionally, consider factors such as their financial stability and track record in handling claims.

3.2 Comparing Coverage Options

Once you’ve narrowed down your list of potential insurance providers, it’s time to delve deeper into their coverage options. Understanding the types of coverage required by law in Colorado, such as liability insurance, is essential. However, you may also want to consider comprehensive and collision coverage to protect your vehicle from various risks. Explore whether the provider offers additional coverage options like uninsured motorist coverage, roadside assistance, or rental car reimbursement, as these can be valuable in case of unexpected events.

Create a table comparing the coverage options of different insurance providers, listing the types of coverage offered, the limits, and any additional benefits or features. This table will help you visualize and compare the options, making it easier to identify the provider that offers the most comprehensive coverage for your budget.

3.3 Analyzing Customer Reviews And Satisfaction Ratings

While insurance providers may boast about their coverage options and competitive pricing, it’s important to know what their customers actually think. Analyzing customer reviews and satisfaction ratings can give you a better understanding of the quality of service and overall customer experience. Look for independent review websites and customer feedback platforms to gather insights. Pay attention to factors like claim handling, customer support, and ease of making policy changes. By considering others’ experiences, you can make a more informed decision when selecting your car insurance provider.

Compile an unordered list of key benefits of analyzing customer reviews:

- Insight into claim handling efficiency

- Understanding the quality of customer support

- Identifying any potential issues with making policy changes

Combining thorough research of different insurance providers, careful comparison of coverage options, and analysis of customer reviews and satisfaction ratings, will allow you to find the best car insurance deals in Colorado. Don’t rush this process; take your time to ensure you make an informed decision that provides optimal protection for you and your vehicle.

4. Tips For Getting The Best Car Insurance Quotes

When it comes to purchasing car insurance, getting the best quotes is essential. Not only can it save you money, but it can also provide you with the coverage you need. To help you secure the best car insurance quotes in Colorado, we have gathered four tips that will guide you in the right direction. From maintaining a good driving record to considering discounts and incentives, follow these tips to ensure you get the best car insurance quotes possible.

4.1 Maintaining A Good Driving Record

Maintaining a good driving record is one of the key factors that insurance companies take into consideration when quoting you a price. Insurance providers prefer to insure drivers who have a clean driving history, as it indicates that they are less likely to be involved in accidents. To maintain a good driving record:

- Follow all traffic laws and rules to avoid receiving any traffic violations.

- Avoid reckless driving, such as speeding or aggressive maneuvers.

- Take defensive driving courses to demonstrate your commitment to safe driving.

- Keep your distance from other vehicles and be mindful of your surroundings while on the road.

4.2 Choosing The Right Coverage Limits

Choosing the right coverage limits is another crucial aspect to consider when seeking the best car insurance quotes. Coverage limits determine how much the insurance company will pay in the event of an accident or damage. It is important to strike a balance between adequate coverage and affordable premiums. Factors to consider when choosing coverage limits include:

| Factors to Consider | How to Determine |

|---|---|

| The age and value of your vehicle | Assess the worth of your vehicle and consider if it is worth insuring for its full value. |

| Your financial situation | Calculate how much you can afford to pay out of pocket in the event of an accident. |

| Your driving habits and location | Consider the likelihood of accidents or theft in your area, as well as your regular driving patterns. |

4.3 Considering Discounts And Incentives

Insurance companies often offer various discounts and incentives to attract customers. These discounts can help lower your premiums and make your car insurance more affordable. When shopping for car insurance quotes, be sure to ask about any potential discounts that may apply to you. Common discounts to inquire about include:

- Multi-policy discounts for bundling car insurance with other types of insurance, such as home or renters insurance.

- Safe driver discounts for maintaining a clean driving record.

- Good student discounts for young drivers who have excellent academic performance.

- Anti-theft device discounts for vehicles equipped with security systems.

By considering these discounts and incentives, you can maximize your savings and get the best car insurance quotes in Colorado.

Credit: www.usatoday.com

5. Final Thoughts

As we conclude this discussion on car insurance quotes in Colorado, it is important to reiterate the significance of regularly reviewing your car insurance quotes. Additionally, staying informed about changes in insurance policies and regulations is equally important in order to ensure you have the appropriate coverage and stay compliant with the law. Let us delve further into these two important aspects.

5.1 Importance Of Regularly Reviewing Car Insurance Quotes

Regularly reviewing your car insurance quotes is essential to ensure you have the best coverage at the most competitive rates in Colorado. Insurance rates can fluctuate, and new discounts or promotions may become available over time. By reviewing quotes from different insurance providers on a regular basis, you have the opportunity to potentially save money and make informed decisions about your coverage.

Moreover, as your circumstances change, such as buying a new car or relocating to a different area, your insurance needs might be affected. That is why it is crucial to stay proactive and update your car insurance quotes accordingly. Regularly reviewing and updating your quotes helps you tailor your coverage to best suit your specific needs and circumstances.

5.2 Being Aware Of Changes In Insurance Policies And Regulations

Being aware of changes in insurance policies and regulations is crucial to ensuring you have the right coverage and stay compliant with the law. Insurance policies are subject to updates and revisions, and it is essential to stay informed about any changes that may impact your coverage. By regularly reviewing your insurance quotes, you can stay proactive and adapt your coverage as needed.

Additionally, being aware of changes in insurance regulations is equally important. Legal requirements regarding minimum coverage levels and mandatory policy inclusions may change over time. By staying informed about these changes, you can avoid any potential penalties or legal issues that may arise if your coverage does not comply with the current regulations.

In conclusion, regularly reviewing car insurance quotes and staying aware of changes in policies and regulations are two fundamental aspects of responsible car insurance management in Colorado. By taking the time to review and update your quotes, and staying informed about any changes, you can confidently drive on the roads knowing that you have the appropriate coverage to protect yourself and others.

Credit: www.nerdwallet.com

Frequently Asked Questions On Car Insurance Quotes Colorado

What Is The Cheapest Car Insurance In Colorado?

The cheapest car insurance in Colorado depends on your individual circumstances and insurance requirements. It is important to compare quotes from multiple insurance providers to find the best coverage and rates for your needs.

How Much Is Car Insurance In Colorado Per Month?

Car insurance in Colorado can vary, but on average, it costs around $150 to $200 per month. Factors like your driving history, age, and the type of car you drive can affect the price. Generally, it’s a good idea to shop around and compare quotes from different insurers to find the best rate for you.

Who Generally Has The Cheapest Car Insurance?

Young and unmarried drivers often pay more for car insurance due to their higher risk profile. Those with a clean driving record and good credit score usually qualify for lower rates. However, it’s best to compare quotes from multiple insurance providers to find the cheapest car insurance for your specific circumstances.

Why Is Car Insurance So High In Colorado?

Car insurance is high in Colorado due to several factors. Trendy cars, hailstorms, high traffic, and uninsured drivers are the main causes for the increased premiums. Additionally, Colorado has higher medical costs and more accidents compared to other states, leading to higher insurance rates.

Conclusion

Securing reliable car insurance quotes in Colorado is crucial for protecting your vehicle and ensuring peace of mind on the road. By comparing different quotes and understanding the coverage options available, you can find the best insurance that fits your needs and budget.

Don’t leave your car unprotected – take the time to research and find the right car insurance policy for you. Drive with confidence knowing that you are covered in any unfortunate event.